The Ultimate Guide To Offshore Banking

3%, some overseas banks can get upwards of 3-4%, though this might not enough factor alone to financial institution within the jurisdiction, it does tell you that not all financial systems were developed equivalent. 4. International Financial Institutions Have a Much Safer Banking System, It is essential to make certain your properties are saved in a Placing your wide range in a safe and secure, and a lot more notably, time-tested banking system is very important.

The big commercial financial institutions really did not also come close. International banks are much more secure alternative, for one, they require higher resources books than lots of banks in the US and also UK. While numerous financial institutions in the UK and also US require approximately just 5% reserves, numerous international banks have a much greater resources book ratio such as Belize and also Cayman Islands which have on typical 20% and also 25% specifically.

The quickest way to avoid this from happening is to establish a worldwide checking account in an abroad territory account that is outside the reach of the federal government. 6 - offshore banking. Using a Banking System that is Safe and Has Audio Economic Plans in your house nation. Some overseas banks, as an example, do not lead out any kind of money as well as keep 100% of all deposits available.

Excitement About Offshore Banking

While numerous domestic accounts restrict your capacity in holding various other currency religions, accounts in Hong Kong or Singapore, for instance, enable you to have upwards of a dozen money to picked from done in just one account. 8. Foreign Accounts Offers You Greater Asset Security, It pays to have well-protected finances.

Without any type of access to your possessions, how can you defend yourself in court? Cash and also assets that are kept offshore are much more challenging to confiscate due to the fact that international governments do not have any kind of jurisdiction and therefore can not require banks to do anything. Local courts and federal governments that regulate them only have restricted influence (offshore banking).

It's not if - it's when. In the United States, there more than 40 million brand-new suits submitted every year, with 80% of the globe's lawyers living in the United States, that is not too unusual. If you are struck with a legal action you can be essentially reduced off from all your assets before being brought to test.

Offshore Banking - Truths

So make certain to inspect your nations contracts and also if they are a signatory for the Usual Reporting System (CRS). With an offshore LLC, Limited Business or Count on can provide a measure of confidentiality that can not be located in any individual domestic account. Banks do have a passion in maintaining confidential the names as well as information of their clients as in position like Panama where personal privacy is militantly kept, nonetheless, Know Your Consumer (KYC) guidelines, the CRS as well as the OECD have actually significantly improved banking privacy.

Using nominee supervisors can also be made use of to produce another layer of security that eliminates your name from the documents. Takeaway, It is never ever as well late to develop a Strategy B.

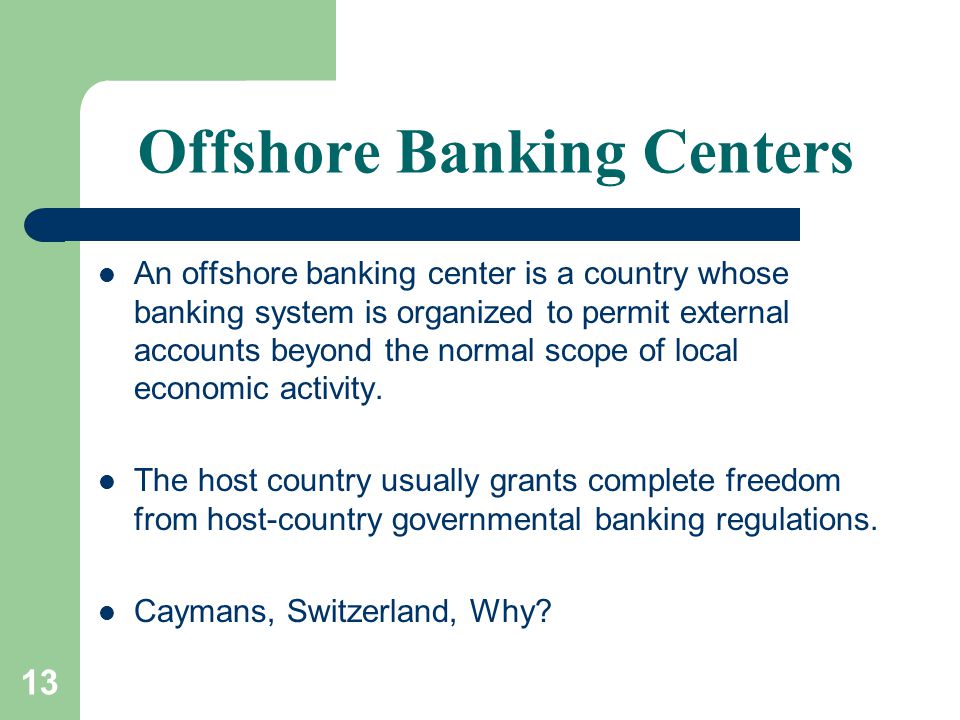

What Is Offshore? The term offshore refers to an area beyond one's residence country. The term is frequently utilized in the financial and also monetary industries to explain areas where policies are various from the house country. Offshore locations are normally island countries, where entities set up companies, investments, and also deposits.

What Does Offshore Banking Do?

Increased pressure is leading to more reporting of international accounts to global tax obligation authorities. In order to certify as offshore, the activity taking area must be based in a nation other than the company or financier's house nation.

Special Considerations Offshoring is flawlessly lawful since it gives entities with a wonderful bargain of privacy as well as confidentiality. There is boosted stress on these nations to report foreign holdings to global tax obligation authorities.

Kinds of Offshoring There are several kinds of offshoring: Organization, investing, as well as financial. This is the act of developing particular organization features, such as production or telephone call facilities, in a nation other than where the company is headquartered.

8 Simple Techniques For Offshore Banking

Business with considerable sales overseas, such as Apple and also Microsoft, might seize the day to maintain relevant earnings in offshore accounts in countries with reduced tax obligation burdens. Offshore Spending Offshore spending can entail any situation in which the offshore financiers stay outside the nation in which they invest. This technique is primarily made use of by high-net-worth capitalists, as running offshore accounts can be especially high.

Offshore financiers might also be looked at by regulatory authorities as well as tax authorities to make certain taxes are paid.

Offshore jurisdictions, such as the Bahamas, Bermuda, Cayman Islands, and the Isle of Guy, are popular as well as recognized to supply relatively safe and secure investment chances. Advantages and Negative Aspects of Offshore Spending While we have actually detailed some usually accepted pros and disadvantages of going offshore, this area considers the benefits as well as disadvantages of offshore investing.

Offshore Banking Can Be Fun For Everyone

This suggests you might be on the hook if you do not report your holdings. Make sure you pick a credible broker or financial investment professional to guarantee that your money is handled appropriately.

why not look here have a peek at this website Get the facts